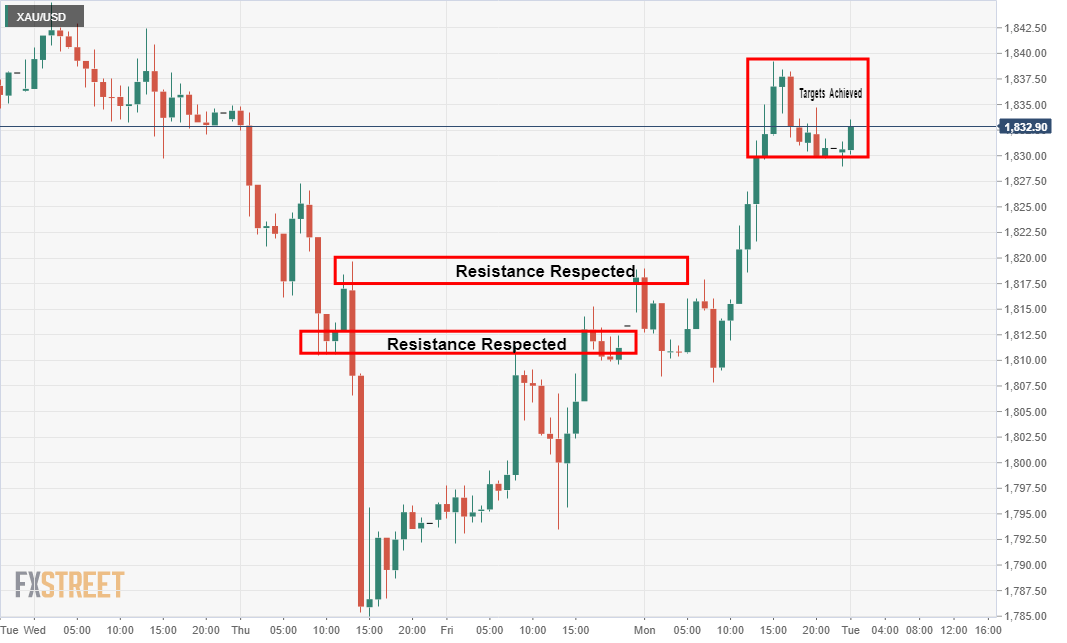

TEHRAN (Iran News) – As per the prior analysis, where gold was presumed to move higher given the structure and bullish chart formation, explained here, the bulls did indeed extend to the target:

Live market, 1-hour chart

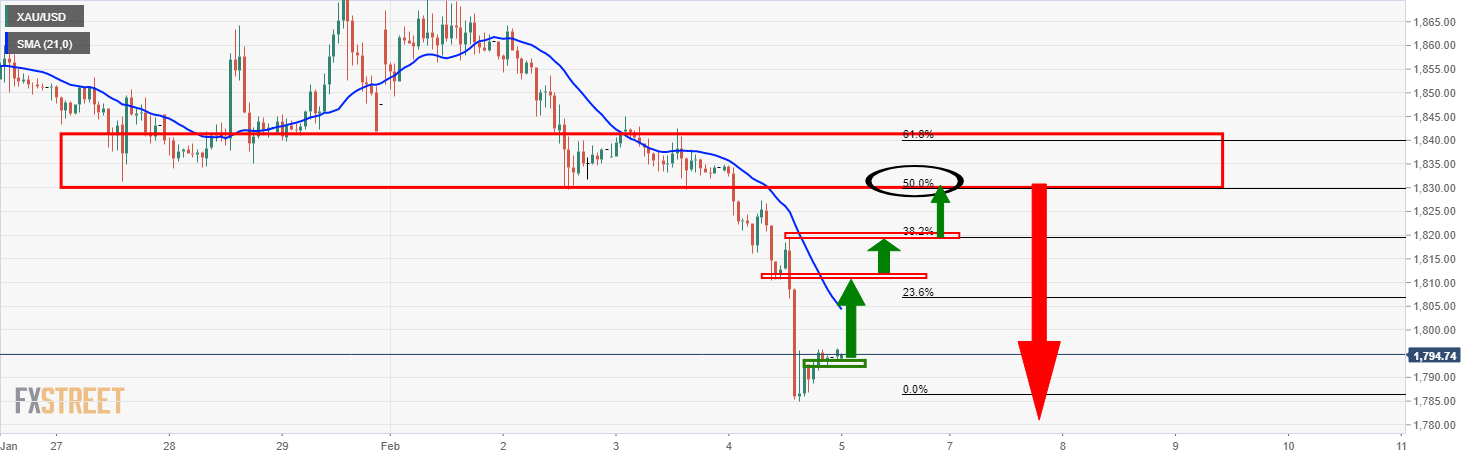

Here was the prior analysis:

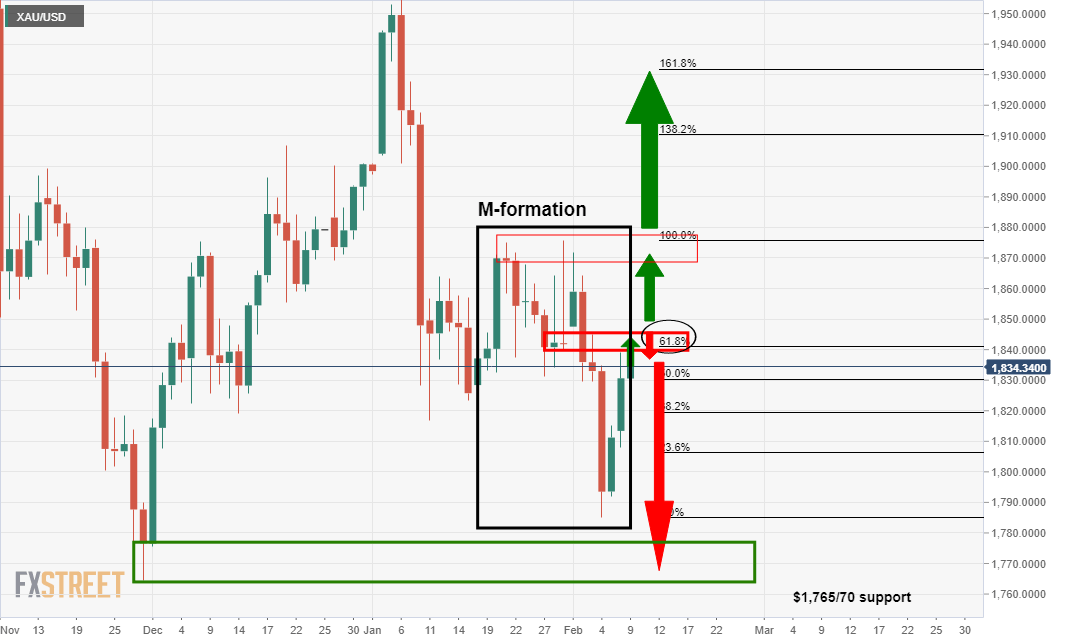

And here it was from a daily perspective, noting the M-formation and target at the neckline:

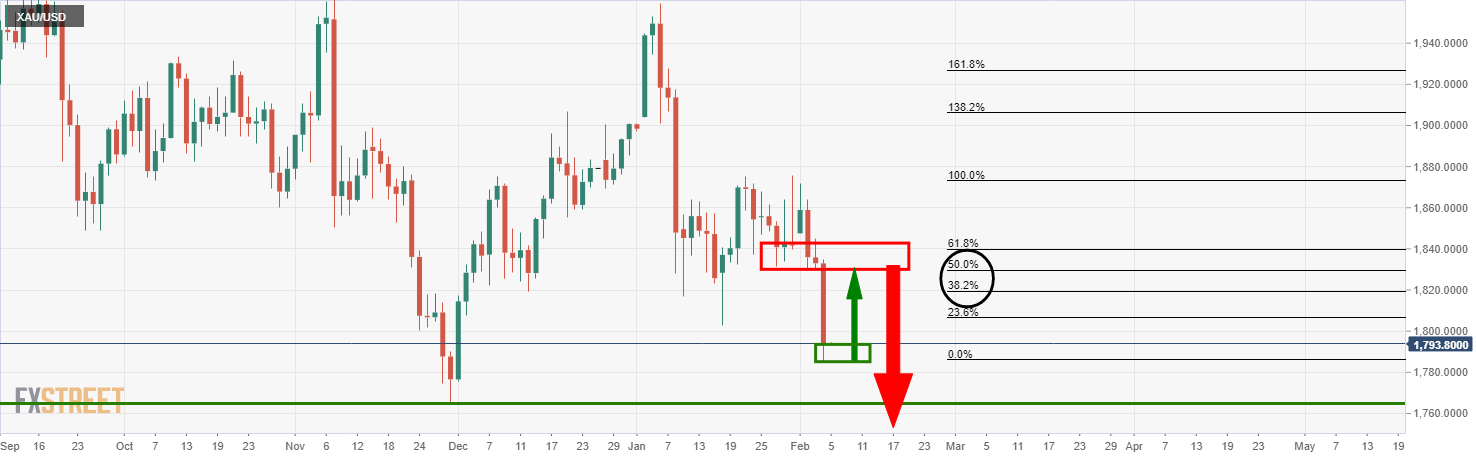

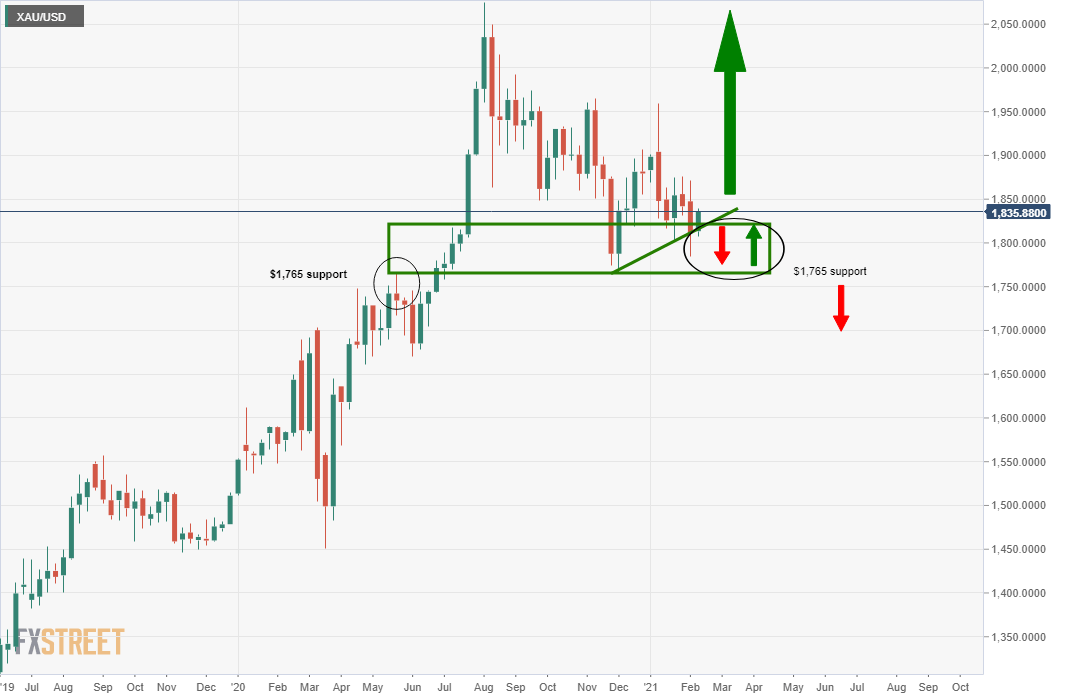

“Gold Price Analysis: Bears to target a run to weekly support at $1,765”

What now?

There is still room for some additional gains to the upside from where it will be made or break time. ”

Daily chart, gold

An extra push deeper into the bear’s lair could be on the cards in a fuller test of the resistance area.

A break of which will open prospects of a run to the prior highs and/or higher still.

If the bears jump on this from there, then a strong possibility will be for a downside extension of the last bearish impulse from which the price has been correcting to a 61.8% Fibonacci retracement.

However, from that juncture, the bulls will most probably step up to the plate to protect weekly support at $1,765:

Weekly chart, gold

“Gold Price Analysis: Bears to target a run to weekly support at $1,765”

- source : FXSTREET